How To Invest in Shares in 2020 – Pressks

Source: Demo Account – MetaTrader 5 Supreme Edition – VOW – Monthly Chart – Data Range: March 1, 2009 to January 16, 2020. Taken on January 16, 2020 – Please note that past performance is not a Reliable indicator of future results.

Source: Demo Account – MetaTrader 5 Supreme Edition – VOW – Monthly Chart – Data Range: March 1, 2009 to January 16, 2020. Taken on January 16, 2020 – Please note that past performance is not a Reliable indicator of future results.

To help us make the decision of whether to buy Volkswagen shares or not, it is necessary to know both the technical and fundamental context.

The technical image

The chart above perfectly illustrates the increase in Volkswagen shares in recent months. After the sharp decline linked to the Diesel gate scandal, the start of an uptrend had been halted by resistance at around € 180 a share.

Technical analysis suggests that this bullish trend may last longer as it is supported by a bullish trend line (black on the Volkswagen chart). We can foresee that the price can return to the maximum reached in March 2015 (in green in the graph) during the year 2020.

The fundamental image

After the dieselgate scandal and to deal with numerous lawsuits, the company has already provided sufficient funds to deal with the remaining claims. Volkswagen managed to invest more than 30 billion euros in electric and hybrid cars. An investment that has already started to pay off!

Porsche, part of the Volkswagen group, launched its first luxury electric vehicle, the Porsche Taycan, to compete with Tesla. Other more common urban vehicles have already hit the market, which is good, as governments around the world legislate against gasoline and diesel automobiles.

Volkswagen knew how to anticipate these changes in the market and stay ahead of many competitors. As part of its 2020-2024 plan , the group plans to invest € 60 billion in research for hybrid cars, including € 33 billion for all-electric vehicles. This should enable you to move up among the world leaders in this rapidly changing market.

An option for long-term investors

Therefore, Volkswagen is a stock to buy in 2020. Perhaps one of the most interesting things about Volkswagen is the fact that you will be paid to own your stock. In fact, all public companies pay you to keep their share. For those who do not know it, this process is known as the “dividend distribution”.

Volkswagen wants to reward shareholders who trust the company by paying 4.86 euros in dividends per share in 2020. However, this is reserved for those who buy shares in cash. How can you do this? You can use the Invest.MT5 account, which gives you access to 15 of the world’s largest stock markets. In addition to :

- Free market data in real time

- A state-of-the-art multi-asset trading platform

- Low transaction fees

- No account maintenance fees

- Dividends on the shares you own

Now let’s take a look at the second candidate to buy 2020 shares in the UK and Europe:

Table of Contents

Buy 2020 shares – GlaxoSmithKline Pharmaceutical

After 20 years of forgetting, the British pharmaceutical group is preparing to return in 2020! In fact, for the past two years, GlaxoSmithKline (LON: GSK) stock price has stagnated around its 1998 levels. But things will change rapidly in 2020.

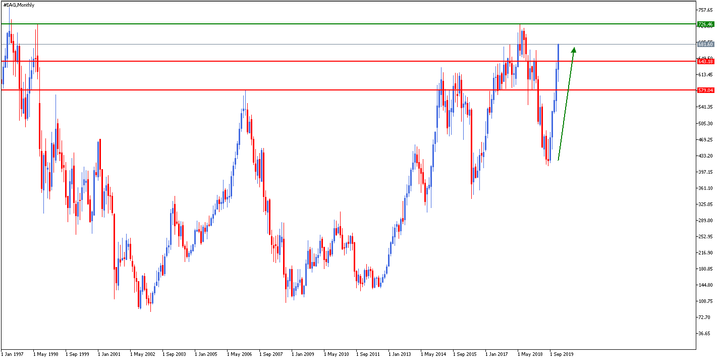

Source: Demo Account – MetaTrader 5 Supreme Edition – GKS – Monthly Chart – Data Range: December 1, 1992 to January 16, 2020. Taken on January 16, 2020 – Please note that past performance is not a Reliable indicator of future results.

The technical image

GSK’s stock price has moved in a lateral range for the past 5 five years (in orange in the chart above). This range was at a key level: halfway between the last maximum reached (green zone) and the last minimum (red zone).

This range is a chartist figure of consolidation, before the resumption of the initial trend, that is, the rise in share prices that started after the rise in the April 2009 low to $ 982.

The GSK listing managed to break the upper limit of the range around 1730 pounds, hence the technical analysis tells us that the rally is resuming and that the goal of the stock price is to return to the all-time highs of the stock. in 2020. It is a positive sign for the purchase of 2020 GSK shares.

The fundamental image

There is a lot to say about Glaxo! But let’s make it simple and effective.

Investors have recently chosen a new CEO, Emma Walmsley, to restructure the company, as it has not been productive in research and development of new drugs for the past decade.

Emma Walmsley has already laid off 40% of the company’s top executives, and is preparing to split it in two, an operation that will allow stock prices to rise in 2020. For the new director, the goal is to separate the drugs intended for the general public of pharmaceutical and vaccine research.

The goal is to make the stock market price more accessible and to attract investors, while allowing each of its two branches to be more specialized and more optimally managed. Items that should help create great added value for those who want to invest in GSK stocks in 2020.

An option for long-term investors

In addition to offering a great value-added opportunity in 2020, buying 2020 shares of GSK allows you to benefit from attractive dividends. If you look at the dividend yield of the company, it amounts to 4.72%! Something to add to your list of best stocks to invest in 2020.

Best Stocks to Invest in US Markets

Since Donald Trump won the 2016 presidential election, the U.S. stock markets. USA They have been climbing upwards, breaking records in 2019. Despite the tariff dispute between the US. USA And China, investors have been enjoying the Trump government’s tax cuts. More money for American companies has translated into jobs, economic expansion, and healthy corporate profits.

Growth, in general, is strong and could be here to stay. Like, Jim Caron, a fund manager at Morgan Stanley Investment Management says: “We are seeing higher productivity and more business investment, indicating that this is not a simple effect related to tax cuts.”

So which companies are emerging as the best stocks to buy in 2020 for the US markets. ? Let’s find out:

Amazon – Buy shares of a GAFA giant

Amazon officially became the second company in the United States to reach a valuation of a billion dollars. That metric alone makes the stock a worthy competitor to the 2020 investor portfolio.

But, there are other reasons that make Amazon special and worth considering as one of the best stocks to buy today, and the best stocks to buy in the U.S. markets.

However, Amazon had an impact on its results for the third quarter of last year, linked to a sharp increase in logistics expenses for overnight deliveries.

Source: Demo Account – MetaTrader 5 Supreme Edition – GKS – Monthly Chart – Data Range: August 25, 2013 to January 16, 2020. Taken on January 16, 2020 – Please note that past performance is not a Reliable indicator of future results.

The technical image

Amazon’s shares have increased meteorically in recent years. The stock price hit a record high at $ 2,050 before correcting to bounce off its bullish trend line. The trend line is manifested by oblique bullish support (in green on the chart above) that has lasted for more than 2 years.

Amazon’s stock price halted its bullish momentum twice at the $ 2,050 resistance. Therefore, the share price moves in a bullish triangle!

During the second half of last year, prices began to consolidate around $ 1,750, as evidenced by the latest candles on the Amazon stock. Therefore, the trend is clearly bullish in the evolution of Amazon 2020 shares according to the technical analysis. Now you need to find the best entry point before the next bullish momentum that should break the rising triangle.

The fundamental image

Although Amazon’s stock has seen a meteoric rise in 10 years, last year’s third quarter results disappointed analysts. While Amazon’s revenue exceeded expectations by $ 70 billion, earnings were significantly lower than the expected $ 2.1 billion.

Is this a bad thing? Not at all, quite the contrary!

The cost of Amazon shipping services increased 50% when single-day delivery launched. But in the long run, it is a strategic option that can pay huge dividends for Amazon and its shareholders. In fact, a study of orders placed by users has shown that the faster items are delivered, the faster the user places their next order.

Therefore, this should allow Amazon to maintain its status as a market leader and increase its billing and profits in the long term and from the year 2020. Meanwhile, Amazon can trust its online data storage service that generated 9 billion of dollars in sales in a quarter, 40% of which was profit.

Therefore, the context is clearly favorable for Amazon, in the short term thanks to its Amazon web service and in the long term thanks to its e-commerce platform. And consider the advice of the legend Warren Buffett : “Buy low, sell high”! Which makes perfect sense here, in 2020, buying Amazon stock taking advantage of the slump and then the looming rising wave.

Bank of America – Buy Bank Shares 2020

Did you know that Bank of America is the second largest company in the portfolio of the investment firm of Warren Buffett in 2020? The successful investor even increased his stake by $ 1.1 billion last year.

Why is Bank of America on our list of stocks to buy in 2020 (and Warren Buffett’s)? Let’s see this immediately!

Source: Demo Account – MetaTrader 5 Supreme Edition – BAC – Monthly Chart – Data Range: June 1, 1999 to January 16, 2020. Taken on January 16, 2020 – Please note that past performance is not a Reliable indicator of future results.

The technical image

As you can see from the chart above, the 2008 crisis hit Bank of America hard and drove the stock price to its all-time low below $ 3 a share in February 2009. Since 2011, the share price It has started to recover and enter an uptrend. The bullish trend is observed on the chart by a bullish tilt in green. We could even interpret that the price is in a bullish channel.

After a first upward momentum, prices had entered a consolidation phase and locked in an ascending triangle: a chartist figure announcing a continuation of the current (upward) trend.

Technical analysis therefore tells us that the share price should continue on its way, returning towards the all-time high of $ 55 during 2020! So why not take advantage of it?

The fundamental image

In 2020, Bank of America has 66 million clients in the US alone. ! The bank has become one of the leaders in its sector, thanks to its 4,350 shopping centers and its growing online and mobile banking activities. But this situation is completely new for the bank!

With the 2008 crisis, the bank lost $ 134 billion and an additional $ 64 billion in legal proceedings. And that’s where Brian Moynihan, CEO of Bank of America, comes in! It managed to restructure the bank, reorienting it to traditional banking activities (loans, checking accounts, credit cards, etc.) while applying a cost reduction policy.

This good management allowed the company to increase its net profits by 4% in the third quarter of last year, bringing them to 7,500 million dollars. Therefore, we can say that the strategy, although it took time and was carried out discreetly, has been worth it! And it’s what draws us, as well as Warren Buffett.

Therefore, we can consider that Bank of America could be a candidate for the list of the best stocks of 2020 with great potential to return to its record highs of $ 55 per share.

Alibaba – Best Chinese Stocks 2020

The Chinese e-commerce giant for goods and services concluded last year with its IPO on the Hong Kong Stock Exchange . Until now, the Chinese company has been listed on Nasdaq in New York. This IPO is the most important of last year, just behind Aramco.

Why might Alibaba be one of the best stocks to buy in 2020?

Source: Demo Account – MetaTrader 5 Supreme Edition – BABA – Monthly Chart – Data Range: June 5, 2016 to January 16, 2020. Taken on January 16, 2020 – Please note that past performance is not a Reliable indicator of future results.

The technical image

Following its IPO, Alibaba’s stock price began a strong upward trend until recently hitting a record high, at $ 231.

The stock price was in an ascending triangle, between the horizontal resistance of $ 210 and the ascending trend line materialized by an oblique support. Based on technical analysis, this type of configuration heralds a continuation of the upward trend as soon as horizontal resistance breaks. And this is what happened.

It is possible that the price will return to that area, as a correction, and then return to its historical maximum, so it can indicate a signal to buy shares in Alibaba for 2020, with a good upward perspective in this weekly chart.

The fundamental image

If the trade war between EE. USA and China influenced Alibaba’s share prices for a time, it did not last thanks to the development strategy and the numerous partnerships developed by the Chinese firm, and this despite the announcement that Jack Ma, its historical founder, retired last year.

Last year, Alibaba registered an increase of more than 50% in its annual turnover. At the same time, earnings posted for the third quarter of last year were up 260% to stand at 72.54 billion yuan! The group is particularly benefiting from the advancement of home catering in China.

At the same time, the group continues to expand its activities and has established various partnerships, notably with Russia, to begin settling in Europe and preparing to face its US rival Amazon. Until now the two groups had not competed with each other due to their geographical location.

During 2020, Alibaba will be able to rely on the infrastructures of the new Silk Road to develop in Eurasia. Finally, the valuation and low value of Alibaba’s share price also attracts private and professional investors. Being at an affordable price, the stocks have a higher upside potential than that of the American competitor.

The fundamental and technical analysis therefore confirms the interest in buying Alibaba shares in the portfolio and largely justifies the Chinese company’s place in the list of the best stocks to buy in 2020!

All the analyzes carried out can be reflected on your trading platform, to follow the evolution of the stock price and thus form your list of best stocks to invest. If you still do not have it, download it for free through the following image.

The best stocks to invest in the Ibex 35

CELLNEX

Cellnex Telecom was the star value of the IBEX35 in 2019, practically doubling its price at the end of the year, and everything indicates that it could continue to be so in 2020. The telecommunications company, which went public in 2015, seems not to It has peaked because it continues to lead the main index of the Spanish stock market with a revaluation of 9% in the first half of January 2020 until reaching 42 euros per share, its all-time high.

There are reasons to believe that Cellnex Telecom may continue to be one of the best stocks on the Spanish stock market in 2020 and, therefore, to take it into account when preparing our trading portfolio. The consensus of the analysts places its target price beyond 45 euros and has very positive evaluations from the large investment firms.

Source: Demo Account – MetaTrader 5 Supreme Edition – CLNX – Monthly chart. Data range: May 1, 2015 to January 17, 2020. Taken on January 17, 2020. Please note that past performance is not a reliable indicator of future results.

The technical image

As we can see in the previous chart, Cellnex did not take off on the stock market until 2017, almost two years after it started trading and six months after entering the IBEX35. During the following two years, the telecommunications operator maintained a moderate but clear upward trend. Between July 2018 and March 2019, the share price was in a lateral range – marked by the lower green box – and then took off and entered an almost vertical bullish channel that continues today.

The technical analysis indicates that, at the time of writing this tutorial, Cellnex was trying to break its immediate resistance at 42,030 euros, its previous all-time high recorded in October 2019. Will it succeed?

The fundamental image

Cellnex has made very efficient use of the divestments made by large telecommunications operators in infrastructure. Telefónica, Vodafone, etc., have detached themselves from telecommunications towers for which they now pay companies like Cellnex. Thanks to this, the listed IBEX35 has become the main European operator of wireless telecommunications infrastructures.

The Catalan company’s internationalization policy continues in 2020 with the recent purchase of the Portuguese Omtel, an operation that provides it with 3,000 towers and antennas. With this acquisition, Cellnex already has a presence in Italy, France, the United Kingdom, Switzerland, Portugal, Ireland and the Netherlands.

REPSOL

Repsol is another value that we could consider in our portfolio this 2020 despite the fact that it ended 2019 with a discreet advance of 2.4% while the IBEX35 ended with an increase of almost 12%. In addition, it stands out for its high dividend yield. All indications are that the oil company has upside potential in 2020 in a context in which the Organization of Petroleum Exporting Countries (OPEC) has revised upwards the forecast of world demand for crude oil this year to 100.98 million barrels per day.

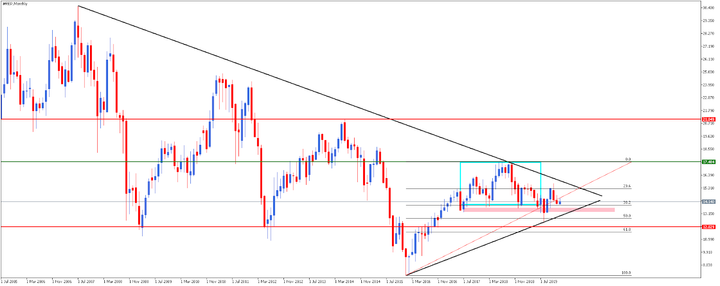

Source: Demo Account – MetaTrader 5 Supreme Edition – REP – Monthly chart. Data range: July 1, 2005 to January 17, 2020. Taken on January 17, 2020. Please note that past performance is not a reliable indicator of future results.

The technical image

If we analyze the price of Repsol in the long term, the price is in a prolonged downtrend since July 2007, as we can see in the graph above. However, since January 2016 it has been within a triangular channel. Inside it we can see the formation of a Shoulder-Head-Shoulder (marked with the blue box) that was not confirmed. If this had been the case, the price would most likely have plummeted to its most important support, at 12 euros, and would have continued until its previous momentum line, around 8 euros.

Finally, the chartist figure was not met and Repsol managed to rebound in the environment of 13 euros, coinciding with 50% Fibonacci. Its first benchmark target stands at 17.5 euros and the next at the psychological level of 21 euros, its last all-time high recorded in 2014. Therefore, Repsol has a consistent upside potential, provided it does not lose 12 euros.

The fundamental image

Repsol is trying to diversify its business to develop new divisions focused on the development of renewables and other lines of business, with the aim of reducing its dependence on the oil sector. In this context, the company entered the electricity generation market in 2018 by purchasing Viesgo. It has also launched Solify, a comprehensive solution that bets on self-consumption of renewable energy.

On the other hand, in the final stretch of 2019 he presented a strategic decarbonization plan with the aim of becoming the first company in the sector with zero emissions in 2050.

At the same time, Repsol has launched a share distribution plan for employees, who may receive part of their remuneration in company securities with an annual limit of 12,000 euros.

IAG

Analysts also predict a good year on the stock market for IAG once the unknowns about Brexit have been cleared, which will finally materialize on January 31, 2020. In this context, the company has announced that the current CEO of Iberia, Luis Gallego, will take over the holding – integrated, in addition to Iberia, by Bristish Airways, Vueling and Aer Lingus – to replace Willie Walsh.

Source: Demo Account – MetaTrader 5 Supreme Edition – IAG – Monthly Chart – Data Range: January 1, 1997 to January 17, 2020. Prepared on January 17, 2020. Please note that past performance is not a Reliable indicator of future results.

The technical image

IAG managed to close 2019 with an increase of 4% thanks to the pull of the second half of the year since in the first months the value was highly penalized by the uncertainty surrounding Brexit. Precisely, the last bounce that we can see in the graph above occurs just after Boris Johnson was elected leader of the Conservative Party and prime minister and the possibility of a hard Brexit was cleared.

At the time of writing, the price was heading towards its next resistance and previous all-time high, set in July 1998.

The fundamental image

IAG has started 2020 by removing the limit on the participation of non-EU shareholders, a measure the airline took a year ago to shield itself against Brexit. The decision to lift the aforementioned restriction, announced on January 17, 2020, was very well received by investors, boosting the price around 6%. The agreement signed at the end of 2019 with Globalia to buy Air Europa was also very well received.

Another point in favor of the airline has to do with the improvement in forecasts by the sector as oil prices stabilize again as tensions in the Middle East cool.

The best bank stocks to invest

Despite experiencing some volatility in the last quarter of 2018, the U.S. stock market has been enjoying a prolonged bullish trend that began in the years after the end of the financial crisis.

In November 2019, the S & P500 index had recovered most of its losses about a year earlier and not only that, but closed at a record high of 3,085.20, having risen from a close of 682.55 in March 2009. It is a notable increase in value of 352% in just over a decade.

As is often the case in such circumstances, much attention has been paid to bank stocks that have experienced rapid growth, as is the case with stocks of tech companies like Netflix, Amazon, Facebook and Tesla.

However, this spectacular increase that has brought the North American market to record levels in its main benchmarks, has led the rest of the group of bank stocks to also experience a strong boost.

Thanks to this, positive movements have been obtained in more traditional investment sectors, this being perhaps overlooked.

In this article we will analyze the growth of some of the main bank stocks, in order to provide a rough guide to the best ones to invest in.

Top 5 US bank stocks

Although the US banking sector was particularly affected during the financial crisis, it recovered at an even faster rate compared to the overall market.

Today, big banks make money in many ways, and their services include areas of consumer and small business financial services, asset management, and financial transaction processing.

In the United States, a favorable environment has been created to carry out such businesses, mainly thanks to the accommodative monetary policy used by the North American Federal Reserve (FED), with its more than well-known quantitative easing (QE) after the financial crisis.

We can see this reflected in the development of the price of bank shares of large investment banks.

For example, the Dow Jones USD Banks Index (which is designed to measure the growth of companies in the US banking sector) increased from 83.34 points in March 2009 to 509.62 points that have been recorded at 20 of January 2020.

This represents a spectacular rise of more than 510%.

Source: S&P Dow Jones Indices – Dow Jones US Banks Index – Data Range: 2010 – January 20, 2020. Conducted on January 20, 2020. Please note: Past performance does not indicate future results, nor is it a reliable indicator future performance

For comparison, the S&P 500 Financials index rose slightly less over the same period, earning just under 500%.

This rough comparison suggests that if you are looking for the best stocks during this period, it might be a good idea to at least take a look at the banking sector and check what the best bank stocks have been.

Source: S&P Dow Jones Indices – S&P 500 Finance Index – Data range: December 2009 – January 2020 – Retrieved on January 20, 2020 – Please note: Past performance does not indicate future results, nor is it a Reliable indicator of future performance.

So let’s take a look at some of the top bank stocks in that index, to help us explore which are the best American bank stocks.

Banking stocks that weigh the most in that particular index are, unsurprisingly, some of the giants in the American banking sector.

Among them we can find:

- JP Morgan

- Wells Fargo

- Citigroup

- Bank of America

- US Bancorp

Of course, we’ll need to add another essential name that should be on our list of largest-cap US bank stocks, and it’s none other than Goldman Sachs.

Next, we will see some statistical data of these bank giants:

| Bank | Stock price growth last 5 years | Market capitalization | P / E ratio | Dividend yield |

| JP Morgan | 113.8% | $ 362.6 bn | 12.1 | 2.9% |

| Bank of America | 188.26% | $ 276.1 bn | 10.62 | 2.1% |

| Wells Fargo | -1.03% | $ 213.9 bn | 12.04 | 3.9% |

| Citigroup | 41.28% | $ 161.6 bn | 8.64 | 2.6% |

| US Bancorp | 34.70% | $ 83.2 bn | 13.04 | 1.3% |

Sources: Market capitalization, Price / earnings ratio for dividend: Onvista. Accessed on November 5, 2019. Share price increase based on closing price from November 05, 2014 to November 05, 2019. Please note that past performance is not a reliable indicator of future results

Are you clear about the best stocks to invest in but don’t know what strategy to follow? Then reserve your place in our free trading webinars. You will learn everything about trading!

Best bank stocks in the US USA

Of course, it’s not just bank giants that have enjoyed more than healthy growth in their bank stock prices.

If we focus on US banks whose market shares are smaller and look at how the best banking stocks of regional banks have performed, we can also find impressive benefits.

For example, if we look at Southwest regional banks like the First Financial Bank Shares (ticker FFIN), we can see that their share price growth is over 100% in the same five-year period.

Next, we will see a table similar to the previous one of the shares of First Financial Bank and other similar bank shares:

| Bank | Stock price growth last 5 years | Market capitalization | P / E ratio | Dividend yield |

| First Capital Inc (FCAP) | 153.42% | $ 198.98 mn | 19.02 | 1.6% |

| Bank First Corp (BFC) | 227.8% | $ 495.95 mn | 19.72 | 1.14% |

| United Community Finl Corp (UCFC) | 127.45% | $ 558.58 mn | 15.48 | 2.63% |

| Capital City Bank Group Inc (CCBG) | 101.01% | $ 487.72 mn | 17.44 | 1.55% |

Sources: Market Cap, Price to Earnings Ratio (P / E), and Dividend Yield: TheStreet – Retrieved on November 5, 2019. Share price increase based on closing price from November 05, 2014 to November 05, 2019. Please note that past performance is not a desirable indicator of future results

UK bank stocks and the Brexit effect

However, it has been a different story for the actions of British banks. While the United States economy has been in a steady upward march, the UK economic outlook has been complicated by the impending prospect of Brexit. While the direct economic impact so far is debatable, the uncertainty of the whole situation has served to make the UK a less attractive proposition.

London has long enjoyed a position as the financial center of Europe, and Brexit raises the possibility of undermining this status quo; for example, the rating agency Moodys has forecast that slower economic growth as a result of Brexit uncertainty will lead to a deterioration in operating conditions for the UK banking sector.

We can see evidence of this when we look at the performance of some stocks in the major British banks, during the same comparison period that we used when looking at U.S. bank stocks:

| Bank | 5-year share price growth |

| Lloyds banking group | -24.25% |

| HSBC | -4.53% |

| Royal Bank of Scotland | -42.89% |

| Barclays | -28.96% |

Source: Market capitalization – Price / earnings ratio and dividend yield: Onvista – Accessed on November 5, 2019 – Stock price growth based on comparison of closing share prices on November 5, 2014 at November 5, 2019 – Please note: Past performance does not indicate future results, nor is it a reliable indicator of future performance.

As we can see, shares in Royal Bank of Scotland (RBS), Barclays, Lloyds and HSBC have declined during the period.

This shows how important it is to consider the specific environment of the economic region in question when investing. Through a period of global growth, there has been a marked difference in the performance of stock prices among the major US banks. USA and the big banks in the UK.

What did the best actions selected for 2019 do?

First of all, we remind you that past performance is not an indication of future performance. But we do know that investors are always curious about performance histories.

So here we review the performance of our stock selection for the past year, and surprise, you’re 100% optimistic!

To buy European shares, we chose Kering and Experian

- Kering performed well last year with all-time highs reached this January 2020, as shown in the chart below in the green box. Over the past year, the price has increased by more than 50%!

Source: Demo Account – MetaTrader 5 Supreme Edition – KER – Weekly chart – Data range: October 6, 2013 to January 17, 2020. Taken on January 17, 2020 – Please note that past performance is not a Reliable indicator of future results.

- Experian also had a good year in the markets with a record high in share price earlier this year at £ 2,679, a return of over 40% between the beginning of the year and its record!

Source: Demo Account – MetaTrader 5 Supreme Edition – EXPN- Weekly chart- Data range: January 12, 2014 to January 17, 2020. Taken on January 17, 2020 – Please note that past performance is not a Reliable indicator of future results.

To buy the best US stocks USA, we choose Amazon and Berkshire Hathaway

- Amazon: The American online trading giant was already part of our selection of the best stocks to buy in 2019 and indeed registered a good increase of 27% when it reached its annual maximum of $ 2035 in July.

Source: Demo Account – MetaTrader 5 Supreme Edition – AMZN – Weekly chart- Data range: from September 29, 2013 to January 17, 2020. Taken on January 17, 2020 – Please note that past performance is not a Reliable indicator of future results.

- Berkshire Hathaway: The investment company of the legendary Warren Buffett, which specializes in equity investments, has benefited from the rise in the stock market and numerous records! The company experienced positive share growth of 11% compared to the annual peak in December.

Source: Demo Account – MetaTrader 5 Supreme Edition – BRKB – Weekly chart – Data range: September 29, 2013 to January 17, 2020. Conducted on January 17, 2020 – Please note that past performance is not a Reliable indicator of future results.

You can check the performance of the shares in a free demo account. These types of accounts are used with virtual funds, so they are ideal to practice with real market conditions.

How To Invest in Shares The five best actions in the last twenty years

Over the past twenty years, different sectors and industries have transcended to new levels, primarily through M&A strategies. The two most prominent sectors are biotechnology and technology, which have expanded significantly in the last twenty years.

Here is the list of five stocks that have been the best long-term investments, producing high returns.

Celgene

(NASDAQ: CELG)

Celgene Corporation is among the largest biotech companies in the world. Its market capitalization is 83,842.87 million dollars as of January 17, 2020.

The clinical failure, the regulatory rejections and the disappointment of the investors caused that in the year 2018 the loss of more than 50,000 dollars in the value of the company in the market was caused. But the price is recovering favorably.

The company sells popular drugs like Revlimid and Thalomid. Through research and development (R&D) and acquisitions, the organization has been creating a large portfolio of medicines.

Manzana

(NASDAQ: AAPL)

The giant computer company known as Apple experienced initial growth in the 1970s and 1980s. However, in 1996 Apple experienced a rapid decline. The company’s shares were worth just 91 cents, after adjusting for dividends and stock splits.

After a major redesign and effective marketing of its most popular products (MacBook, iPhone, iPad, iOS) and the appearance of new products like the Airpords, its shares have reached a record high of $ 317 in January 2020.

Source: Demo Account – MetaTrader 5 Supreme Edition – APPL – Weekly chart – Data range: December 1, 2013 to January 17, 2020. Taken on January 17, 2020 – Please note that past performance is not a Reliable indicator of future results.

Alphabet

(NASDAQ: GOOG)

Google owner Alphabet, one of the largest companies in existence today, has become the fourth American company to achieve a market capitalization of more than $ 1 trillion.

As of January 17, 2020, Google’s share price stands at $ 1,460, with a growth rate of the last 3 months exceeding 17%.

It is the leader of the internet search market. Google has also added a large number of different products to its business portfolio, for example, the Android operating system. The Android operating system is one of the most popular mobile operating systems in the world, if not the most popular.

Gilead Sciences

(NASDAQ: GILD)

In February 1996, Gilead Sciences shares were worth $ 1.10 (adjusted for dividends and stock splits). However, in February 2016, the share price was $ 87.36 relative to the app, and 24.5% in compound annual return. Its broad portfolio of medicines has been created through disparate internal investigations and acquisitions. Today’s company is one of the largest biotech firms in the world. Its most popular products are Atripla, Sovaldi, Truvada and Harvoni.

Microsoft

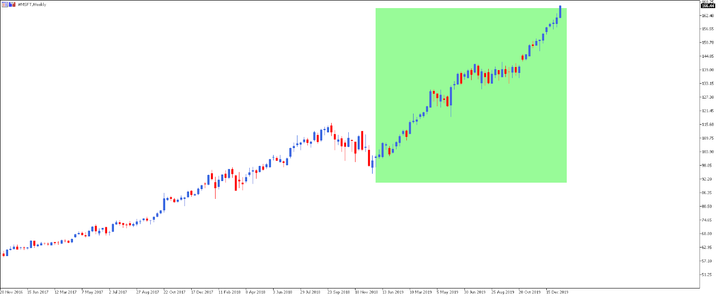

(NASDAQ: MSFT)

In 1975, the now famous Bill Gates and his friend Paul Allen started a computer company called Microsoft. Ten years later, the world witnessed the birth of the first Windows operating system (1985). Just a year later, Microsoft’s shares hit $ 21 a share, which is equivalent to 6 cents a share, considering dividends and divided shares. The company really made a revolution in the digital and PC business.

Source: Demo Account – MetaTrader 5 Supreme Edition – MSFT- Weekly chart- Data range: from November 20, 2016 to January 17, 2020. Taken on January 17, 2020 – Please note that past performance is not a Reliable indicator of future results.

Dividends of the best stocks in 2020 – Passive income

When it comes to the stock market, the two most popular ways to invest are: trading in stocks and investing in stocks. Trading in stocks is normally considered a more active approach. Investing in stocks is considered more passive. One of the main differences is the time frame that the buyer is looking to maintain their position.

In stock trading, most buyers would hold their positions for days or weeks. By investing in stocks, most buyers will try to hold their positions for months or even years. After all, there are certain benefits to investing in the stock market, such as:

- Dividend distribution: As an investor, you could create a potential passive income stream with a portfolio of dividend-paying stocks

- Time: This is the only product that you cannot recover. Making long-term investments helps you focus your time on the things that matter most to you, such as friends and family.

- Retirement Planning: Planning for the future is as important as living in the present. The Trading with ETFs is possible even when you start with a small amount

If you are considering investing in the stock market to build your portfolio with the best stocks for 2020, you need to have access to the best products available.

The best stocks to invest in 2020- Conclusion

The year 2019 has been an especially volatile year for different reasons. Among all of them, we would highlight Brexit, the tariff “war” between the US and China and, above all, decisions on interest rates.

However, the stock market in general has not been negatively affected by these events.

One of the main driving forces in global stock markets, which are now trading at record (or very close) levels, is the action of central banks around the world that fear falling into recession.

The United States Federal Reserve, the Reserve Bank of Australia and the European Central Bank, among other things, lowered their interest rates in the hope that costs will decrease. Funding encourages businesses and consumers to borrow more, thereby stimulating growth. In a simpler way: central banks reduce interest rates so that loans are cheaper and encourage consumption.

In fact, billionaire investor and legendary trader Paul Tudor Jones, in late 2019 said in an interview with CNBC that the economy is experiencing an “explosive combination of monetary and fiscal policy at the moment,” which ultimately helps fuel the markets to reach new highs.

However, investors cannot afford to be complacent as there are challenges to come in 2020, such as the United States presidential election. Therefore, having good criteria to identify the best actions to take in 2020 will be an essential point.

We hope we have given you an idea of the best stocks to invest in 2020.

There is also the possibility of investing in stocks through CFDs, to be able to go both long and short.

Click on the image below to invest in the best stocks of 2020!

Other articles that may interest you

- What is Online Trading and how does it work?

- Stocks versus CFDs

- What is volatility in Forex

About Admiral Markets

We are a broker with a global presence and regulated by the highest financial authorities. We provide access to the most innovative Trading platforms. We trade CFDs, stocks and ETFs.

Good Trading!

Admiral Markets

Risk Notice: The data provided provides additional information regarding all analyzes, estimates, forecasts or other evaluations or similar information (hereinafter “Analysis”) published on the Admiral Markets website. Before making any investment decision, pay close attention to the following:

1. This is a marketing communication. The content is published for informational purposes only and should not be construed in any way as investment advice or recommendation. It has not been prepared in accordance with legal requirements to promote the independence of investment reports and is not subject to any prohibition on trading prior to the release of investment reports.

2. Any investment decision is made by each client separately, while Admiral Markets AS (Admiral Markets) will not be responsible for any loss or damage derived from said decision, regardless of whether or not it is based on the content.

3. To guarantee that the interests of clients are protected and the objectivity of the Analysis is not affected, Admiral Markets has established relevant internal procedures for the prevention and management of conflicts of interest.

4. The Analysis is prepared by an independent analyst (Jitan Solanki, Freelance Contributor) based on his personal estimates

5. While every reasonable effort is made to ensure that all sources of the Analysis are reliable and that all information is presented, to the extent possible, in an understandable, timely, accurate and complete manner, Admiral Markets does not guarantee the accuracy or completeness of any information contained in the Analysis.

6. Any prior or modeled performance of the financial instruments indicated in the Publication should not be construed as an express or implied promise, guarantee or implication by Admiral Markets for any future performance. The value of the financial instrument may increase or decrease and the preservation of the value of the asset is not guaranteed.

7. Leveraged products (including contracts for difference) are speculative in nature and can generate profit or loss. Before you start trading, you need to make sure that you understand all the risks.

Comments are closed, but trackbacks and pingbacks are open.