The Guide How to Buy and Sell Google Stock (GOOGL)

Trading Google Stock: The Essentials Google started off as a search engine in 1998, allowing users to get answers to questions and inquiries from various online sources. What started off as a very small business back then, has grown to become a global conglomerate with interests in online advertising, paid and organic online marketing, open…

Trading Google Stock: The Essentials

Google started off as a search engine in 1998, allowing users to get answers to questions and inquiries from various online sources. What started off as a very small business back then, has grown to become a global conglomerate with interests in online advertising, paid and organic online marketing, open source platforms, mobile operating systems (Android OS) and smart technologies.

Just like Facebook, the company has had its fair share of scandals and litigations. The parent company Alphabet has faced anti-trust lawsuits and has been fined very heavily for this. Furthermore, the company is banned from the Chinese market, where Baidu (a local alternative to the search engine) holds sway. Thus, the company has been denied billions of dollars in lost revenue as a result of being locked out from the billion-strong Chinese market.

However, Google continues to be a force to be reckoned with and its stock commands a lot of trading volume and volatility, making it suitable for trading on various platforms. This guide will examine what it takes to trade Google stocks, the market fundamentals that affect the demand and supply of Google stocks, how to trade Google stocks with technical analysis and how to trade Google stock on three of the most popular retail trading platforms.

Google is listed on the Nasdaq as a tech stock, sharing the same cast as Facebook, Microsoft, Apple, Amazon and Yahoo! According to Google CEO Larry Page, Google is a technology company which uses technology to solve human problems.

Aside from its well-known services such as a web search engine, a mapping software and a language translation service, Google also has hardware products that its company has made over time. These include hardware devices such as robot assistants, computerized contact lenses.

Here are some useful nuggets of information to help you understand some important aspects of Google trading.

- Google stocks can be traded as CFDs on a number of platforms. These platforms enable traders to go long (BUY) or execute short trades (SELL).

- Trading of Google stock can be done using two market orders (BUY and SELL) as well as a variety of pending orders (Buy Limit, Sell Limit, Buy Stop, Sell Stop, etc).

- Trading Google stocks as a CFD means that the trader does not own any Google stock, but is simply buying or selling a contract which tracks the price of Google as it trades on the Nasdaq exchange.

- CFD trading on Google stock is done with leverage. Leverage offered is 1:5 (for EU and UK platforms such as eToro, Forex.com UK and XM Cyprus or XM UK). If the trader resides outside the EU or UK, then leverage provided could be either 1:10 or 1:200. This is the case with the Australian and international platform offerings of eToro and XM).

- Google stocks are subject to technical and fundamental analysis.

Table of Contents

TRADING GOOGLE STOCKS: FACTORS TO CONSIDER

What are the factors that traders must consider when trading Google stock?

- MARKET FUNDAMENTALS

Just like other derivative assets, you can buy or short Google to benefit from rising or falling prices respectively. Google stock’s price at any time is a function of demand and supply. The demand and supply of any stock (Google included) is a product of the psychology or mindset of traders at any time as far as the stock is concerned. As previously identified, traders will be doing any of three things at the same time:

- They could be buying the stock

- They could be selling

- They may decide to stay uncommitted i.e. have no positions on the stock.

The uncommitted traders constitute the important group. When buying and selling is in equilibrium, the stock price will consolidate. During this time, the uncommitted pool of traders will be on the sidelines, waiting for a trigger that will either push them to join the buying party and hence increase demand, or to join the sellers and therefore increase the supply pool. At this time, they are waiting for a catalyst to change their mindset and cause them to take a side on the stock.

If such a catalyst such as an earnings report is released and shows information which is good for the stock, it will push in the uncommitted traders into buying positions. This increases demand and lead to increased buying activity, which drives prices up.

If such a catalyst is released and shows negative information for a stock, it will push in the uncommitted traders into short positions. This increases supply and more selling, which drops prices.

Catalysts ultimately answer the question: is this stock intrinsically viable enough to make money for me if I buy it, or is it overpriced to the point where if I sell it now and buy it later on, I may make money from it (short selling)? These catalysts cause a change in market sentiment, which is basically psychology playing out.

Every stock has its own set of catalysts. Some catalysts are common to all stocks; yet every stock has its own unique set of catalysts. Whether the catalyst is a common one or not, the response of the stock follows a similar pattern:

- If a news release is positive for the stock in question, money flows into the stock, which creates a demand that pushes prices upwards.

- If a news release is perceived as being negative for the stock, then money flows out of the stock and the price drops.

Each fundamental catalyst will produce one of these two responses. This is because the catalysts create a perception in the minds of traders, and will make them either put money in the stock or take money out of it.

Fundamental catalysts for Google stock are as follows:

Earnings Reports: Just like for any other company, Google releases quarterly earnings reports. These reports showcase the revenues, profits and most importantly, earnings per share of the company. The most important statistic in any earnings report is the earnings per share, or EPS. The Earnings Per Share is derived by dividing the total amount of profit generated within the time period under review (usually a quarter or 3 months in an earnings report), divided by the number of shares that the company has listed on the stock market. If the earnings per share are much higher than the prediction of analysts (i.e. market consensus numbers), the stock will experience demand, money will flow in and prices will rise. If earnings per share are lower than the market consensus, money will flow out of the stock, creating more supply than demand and prices will drop.

Notice that we did not say if the company declares profit…it is always a comparison of the actual number with the forecast numbers. Additionally, the results are compared with the same period in the previous year (or previous quarter) in order to see if there is progression or retrogression of the company’s performance. So it is possible for a company to make losses, but if the recent loss is less than previous losses, it is a sign that things are looking up for that company and money will flow into the stock. Similar, a reduction in profits could be interpreted as a bad sign and lead to net selling of the stock rather than buying.

So with an earnings report as catalyst, it is always about comparing the actual numbers with consensus or previous numbers.

But how do traders perceive a news release so as to put money into the stock or remove money from it? This comes from the comparison of numbers.

- First, for any earnings report, there is a previous number: the last released actual figure for the earnings. Most commonly, it is the previous quarter’s earnings per share. Some earnings calendars list the figure achieved in the same quarter for the previous year for comparison purposes.

- There is a consensus number: also called the prediction number. A team of economists are usually polled by financial news outlets or market research sites, and they provide an opinion as to what the earnings will be. For instance, economists can come together to decide that the earnings per share of Google is XYZ cents or dollars per share. This consensus figure now serves as the benchmark on which the actual figure is measured.

- The actual figure is released in an earnings report. A comparison is then made between the actual figure and the consensus figure. If the actual figure is better than the consensus as predicted by analysts, this produces positive sentiment for the stock, money flow into the stock, and prices will rise. If the actual figure is worse than the consensus number, then a negative sentiment is produced and money will flow out of the stock, creating a supply surge and a fall in prices.

But it is not only the actual figure versus the estimate/consensus figure that stock traders will look at. They will also look at the degree of deviation between both sets of numbers. The wider the deviation, the greater will be the market response. So if the actual number is so positive as to create a deviation from the consensus which is wider than the deviation between the consensus and previous number, the response will be that of strong buying. Similarly, a very poor actual reading which has a deviation from the consensus that is wider than the deviation between the consensus and past number, the response will be that of strong selling.

Earnings reports are usually released either in the pre-hours or in the after-hours of the market.

Scandals: Scandals can make and mar a stock. When a stock is a market leader and is plagued by scandal, this can never be good for a company. Google has had its share of scandals. The company’s core business deals with an insane amount of user data. Google is bound to obey privacy laws and preserve user data. It has had its own fair share of scandals involving privacy breaches or unauthorized usage of the private information. One such scandal emerged after 5 million Google passwords were stolen and appeared on Russian cybercrime forums. A CNBC report in 2018 also revealed that 500,000 users had their details exposed by a bug. Just this last August, Google reported that it had found 316,000 accounts that were still using login details from previous breaches.

In 2018, Google paid millions of dollars to an unnamed executive who was fired as a result amidst an allegation into sexual misconduct.

Uber and Google have also sparred off in court over allegations that Uber stole trade secrets regarding the technology behind Google’s self-driving car product Waymo. Google also came under fire in 2018 over its controversial contract with the US Department of Defense to integrate artificial intelligence into its drone systems. A petition by Google employees, criticizing the company’s involvement in “the business of war” ultimately forced the company not to renew this contract.

Such scandals do not make for positive reading and whenever they emerge, money tends to flow out of the stock and causes prices to drop.

New Product: A new product that will lead to an increase in the company’s revenue and profits, or lead to an increase in market adoption of the company as a whole will lead to the stocks enjoying patronage. Google is a tech company and over time, has released a number of technology-based services. It is venturing into AI big time, is developing a self-driving car, and is also developing drones for commercial freight. New products excite investors because these are avenues through which sales can be increased, ultimately leading to increased profits.

- TECHNICAL ANALYSIS

Technical analysis is the use of chart information to predict price movements. It is based on three premises:

- markets move in trends

- history will repeat itself

- market action has priced in everything (including the news)

You can use chart patterns, candlesticks, volume patterns and indicators to predict future price movement of Google stock, even when a news release has impacted prices. A popular market saying urges traders to “trigger fundamentally, enter technically”. So the news gives the direction, and technical analysis shows you where to enter and exit.

Google 4-Hour Chart Showing Various Technical Plays

The chart above shows various chart patterns on Google’s 4-hour chart. There’s a symmetrical triangle pattern (bullish continuation pattern in this case), so the bias would be to buy on the breakout of the triangle. The pattern is defined by tracing a trendline across at least three highs to form the upper border, and three lows to form the lower border. The long entry is done at the break of the upper border. Exit follows the same height as the move which preceded the pattern, extrapolated upwards from the breakout.

We also see a rising wedge, as well as a bullish pennant pattern. Following these patterns on the chart will bring about good trading opportunities.

TRADE REQUIREMENTS

What do you need to trade Google stocks on the three platforms we shall be highlighting?

You are required to know the following before you enter the trade:

- Your leverage/margin requirement

- Minimum allowable trade size

- Risk-reward ratio for the trade

- Maximum risk exposure (should not be more than 3% of total capital)

- Asset contract specifications for Google

Contract specifications, leverage and allowable trade sizes (minimum and maximum) will differ with each broker, and the three brokers showcased here will indicate the differences.

How to Trade Google on eToro – The Tutorial

Here is a step-by-step process of how to trade Google stocks on eToro.

eToro

eToro is a forex and CFD broker that offers the trading of stocks as contracts-for-difference assets. eToro was launched in 2007 and features Google as one of its traded assets. Trades can trade Google manually, or can the CopyTrade facility to follow traders who have Google as part of their trading portfolios. There is also the opportunity to use the Copy Portfolios product to trade a basket of assets that features Google and other assets that share an association with the Google company or its partners. eToro is regulated in the EU and UK.

How to Start Trading GOOGLE Stock on eToro

Step 1: Account Opening

Open an account on eToro and fill out the multi-step registration form. You can also signup with your Gmail or Google accounts.

Questions to be asked include your source of funds, investment experience, a single question to determine your knowledge of trading and risk as a whole and your risk-return tolerance levels.

Step 2: Identity Verification

Provide a government-issued ID such as an international passport as well as proof of residence document (bank statement or utility bill). You will also be prompted to setup 2-factor authentication via SMS. You will therefore need a phone number to which a verification SMS can be sent.

Step 3: Fund your account

Fund your account on eToro using the funding channel and currency available for your country.

Step 4: Start Trading Google stock

eToro allows you to trade Google using manual methods, via copy trading or by using the copy portfolio method.

4A: Trading Google Manually

On the search box at the top of the page, type “Google”. Some traders use usernames that incorporate the names of some stocks. So click on the Google icon with “Trade” beside it. You will be taken to the trading page of Google.

Click the “Trade” button. This directs you to the order box where the trade parameters are selected. You can decide to short the Google stock (Sell) or you can go long on the stock (Buy). You can also use the Trade dropdown button to execute the trade at either market price, or a price different from market price using a limit or stop order (i.e. pending orders).

Trade Google using a leverage maximum of X5. Other leverage allowances are X2 (2 times leverage) and X1 (nil leverage).

In monetary terms or in units of stock, choose your trade size. Set your Stop Loss and Take Profit prices and click OK to execute the trade. You can also visit the Google profile page to view statistics, charts, comments and social feeds.

4B: Copy a Google Trader Using CopyTrader™

CopyTrader™ is eToro’s proprietary social trading platform. You can use this to select traders who buy or sell Google to copy their trades. It is best to use the selection metrics provided by eToro to filter the traders so you choose the most profitable. Use parameters such as risk score, performance stats (6 months minimum), performance graphs and asset portfolio to make your selection.

Most stock traders on eToro will not be trading only Google, so you need to copy a trader whose portfolio includes Google stock and is doing well. Using the CopyTrader™ dialog box, select your Copy Limit and the amount you want to commit to the copy trade, then click on Copy to execute the trade.

Step 4C: Place a CopyPortfolios™ trade

CopyPortfolios™ allows traders to copy multiple portfolios built around the Google stock. Such portfolio assets may include the Nasdaq index (of which Google is a major component), or a company which builds its product base around Google’s products.

Here, we chose a portfolio where the trading fund was majorly invested in stocks, with Google being a large part of that portfolio.

Click on the “Invest” tab to start your investment. From the snapshot below, you can see that there is an opportunity to choose the amount you want to invest and you maximum investing limit.

Look at the pros and cons of eToro to decide whether it is a good place to buy or sell Google shares. As you can see, there are more pros than cons.

Pros

- Fast account opening.

- Sign up with Gmail and Facebook as alternative sign-in facilities.

- Copy other successful traders using the CopyTrader™ platform.

- You can copy an entire themed portfolio investment using CopyPortfolios™.

- Fees are low.

- Low minimum deposit ($200 or 200 Euros)

- Regulated brokerage.

- User-friendly interface

Cons

- Leverage is restrictive for Google trading (1:5).

- Charting package is difficult to use.

VISIT ETORO NOW

How to Trade Facebook Stock on Forex.com – The Tutorial

Forex.com

Forex.com has a US and UK operation, with the UK operation being the only entity allowed to provide services to the international audience. Also, the Forex.com UK is the only branch of GAIN Capital Group allowed to offer CFDs on stocks, so this is where you will trade your Google stocks. Forex.com is regulated by the UK’s Financial Conduct Authority (FCA). Popular features include social feeds, research and One Click Trading.

How to Start Trading GOOGLE Stock on Forex.com

Step 1: Register your account

First, start by opening your Forex.com account. Fill out your basic profile information. To determine your investor risk profile, you will be asked to answer a few short questions about your investment experience, knowledge and style, as well as your risk-return tolerance. After registration, you will be given your login details.

Step 2: Verify your identity

Attach and submit proof of identity for verification within your members’ area.

Step 3: Fund your account

Funding a Forex.com account can only be done a credit/debit card, bank wire, ACH or a bank cheque. Deposits made using other methods other than bank wires have a $10,000 limit.

Step 4: Trade Google stock

On Forex.com, you are provided a link with which to either download the platforms or to use the webtrader. Trading of stocks is available on the MT5 platform. Use the link to open the login page.

Log in with your email address (username) and your assigned password. After logging in, you will be shown the interface of Forex.com. It incorporates charting from Tradingview and has many of Tradingview’s features.

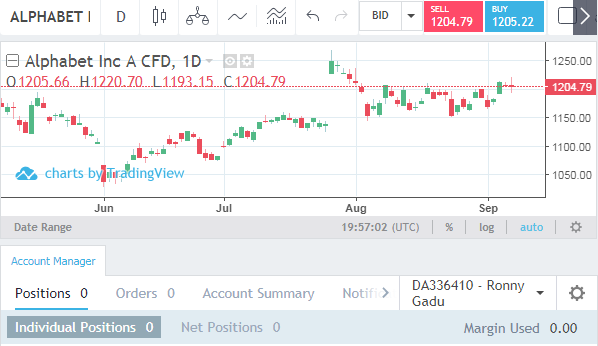

Type in “GOOG” into the space provided. This gives you the parent company’s name, Alphabet. Click on it to open the trading interface.

Step 4A: Place a Google stock trade (manual method)

In the top left corner of the platform, there is a space provided for asset selection. Type the word “GOOGLE” into that space. You will see the stock symbol displayed as shown above. Click on it to load the GOOGLE chart.

Once the chart is loaded, you can trade in two ways. Either you use the Sell (red) or Buy (blue) buttons as shown below, or you right click on the chart and click on TRADING in the drop down menu that appears.

Whichever option you choose, a pop-up will be displayed showing the order parameters as well as risk exposure for any number of units of Google stock you want to buy.

- You can choose a Market, Limit or Stop order for your Google trade.

- You can define your stop loss and profit target (TP).

- You can choose the number of units of Google stocks that you want to purchase.

- Finally, you can click SELL to sell the Google stock, or you can click BUY to purchase Google stocks.

If you want to know what you stand to gain and any potential drawbacks of trading Google shares on Forex.com, check out these pros and cons.

Pros

Cons

- Restricted range of payment methods

- A lot of countries cannot use Forex.com because of broker restrictions.

How to Trade Facebook Stock on XM – The Tutorial

XM

XM is an international brokerage brand operating in several jurisdictions. The brand is owned by the XM Group. XM operates in Cyprus where it offers clients EU trading conditions. Other clients are split between XM Australia and XM Belize (for international clients).

XM offers Google stocks for trading on the MT5 platform exclusively. You can therefore download the MT5 desktop client, or you use the Webtrader and mobile app. The demonstration below focuses on the MT5 Webtrader as this is the simplest way to trade Google on XM.

How to Start Trading GOOGLE Stock on XM

Step 1: Register your account on XM

Due to ESMA regulations, XM Europe will not take on international clients. These will be migrated automatically to either XM Australia or XM Belize. Fill out your biodata in the first page. You will also be asked to choose your US tax status (XM does not take US clients).

As part of your account opening process, you will be asked to choose the platform to use. Please select the MT5 platform as this is the one that lists stocks such as Google for trading. Choose the “Shares Account” type.

Unlike the process in eToro, identity verification is not part of the initial account opening process. You will be required to verify your identity by uploading the relevant documents in your “My XM” members’ area.

Step 2: Choose the Platform Version to Use

XM presents the MT5 platform in various versions: as a desktop client, a browser-based platform, and mobile app for iOS and Android devices. Select the platform version of your choice and load it on your trading station. Since we are demonstrating the trade using a Webtrader, we click on “Access MT5 Webtrader”.

Step 3: Fund your account

Click the Menu button, then click on “Deposit Funds”. You will be taken to the “My XM” area where you have to login using your username and password sent to your email after filling the account opening form. After logging in, use any funding method available on the site and acceptable to you to complete the deposit process.

Step 4: Trade Google stock

You can trade Google on XM’s Webtrader via manual trading. The downloadable version supports the use of forex robots coded with C#. Here’s how to perform manual Google trades on the XM Webtrader.

4A: Buy/Sell Google stock (manual method)

The first step is to access the MT5 webtrader. Go to https://mt5.xm.com, then enter you username and password when prompted to do so. The MT5 platform will display as shown above.

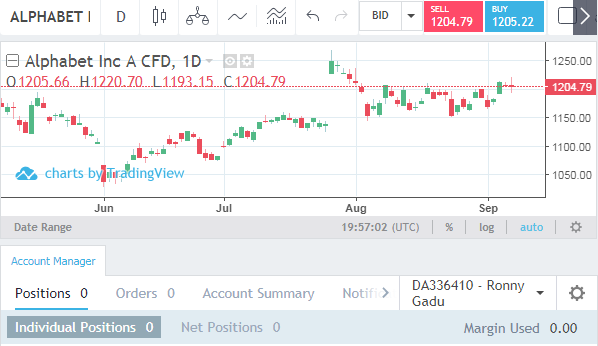

You have to add the Google stock CFD to the list of traded assets on the Market Watch window. Where you see “Click to Add”, enter the word “Google”. A small pop-up will display the name of the Google contract, which you have to click in order for Google to appear in the Market Watch.

Now that Google is in the Market Watch, it is time to trade it. Right click on the Google tab under the Market Watch, and click on Chart Window to display the Google chart.

This now gives you the option of trading Google from the chart. You now have two order options:

- You can repeat the process by clicking the Google tab under Market Watch, then click on “New Order”. This opens the dialog box where you can enter the trade parameters such as the number of units to be purchased, stop loss and take profit settings.

- You can trade directly from the chart using the Sell/Buy tab located on the top left corner of the Google chart. Here, you can only enter the number of units being purchased, as well as Buy order or Sell order at the listed market prices. You have to enter the stop loss and take profit settings from the active trade section in the terminal window.

You also have the option of choosing the Market Order (for instant execution at market prices) or the Pending order types (delayed execution at the price you want).

Step 4B: Using an MT5 Robot

Robots for MT5 platform are coded using C#, which is a different coding language from the MT4 platform. To use the MT5 robots, you must trade on the desktop version. Download the MT5 platform from the XM website, then click on File -> Open Data Folder. This displays the data folder of the MT5 on your computer bottom menu. Click on MQL5 -> Experts, then copy and paste the .mq5 file of your robot into the Experts subfolder. Restart your MT5 platform by closing and opening it again, and the robot is ready for use. Attach it to the chart of Google and allow it pick trades as it has been programmed to do.

Do you want to trade Google shares on XM? Here are the pros and cons of using XM for your Google trades.

Pros

- Account opening process is quick.

- XM is located in several jurisdictions, with different offerings for traders in different locations.

- XM is a regulated forex brokerage.

- Different platforms are available, which allows flexibility in trading.

- Low minimum deposit (200 euros)

- Wide range of payment methods

- Free and unlimited demo account.

- Good market research suite.

Cons

- Google only available on MT5.

- Automated trading is only possible on the desktop version of MT5.

Projection for Google Stock for Rest of 2019

Most of Google’s fundamentals will be driven by how it handles privacy issues within its platform as well as the goings-on with its proposed Libra cryptocurrency.

FAQs

Here are some frequently asked questions about trading of Google stocks.

- What is a Stock CFD Contract?

A stock CFD contract allows a trader to buy or sell a stock from a dealer without taking physical ownership of that stock. The trader is merely buying or selling a contract, based on the price movements of the underlying asset in its listed exchange, which for Google is the Nasdaq or Tech100 index.

- How can I recognize the symbol of Google on any of these platforms?

Simply type the word “GOOGLE” in the space provided for the assets, and you will see a pop-up box displaying the full contract for the Google CFD asset.

- I tried to trade Google and a message said the market is closed. What are the trading hours for trading Google?

Google stocks are traded when the Nasdaq100 index is open for business. This is between 1.30pm GMT and 8.30pm GMT.

- Does my Google trade expire like commodity contracts?

The Google CFD contract does not have an expiration date. The trade will remain open until the stop loss or profit targets are reached, or until the trade is closed manually by the trader.

- How much do I need to trade 1 contract of Google?

It depends on the platform you use. If you trade the Google CFD on any EU or UK platform (Forex.com, eToro Europe or XM Europe), the margin requirement is 20%. If you trade with XM Belize or Australia, the margin requirement is 1%. Each platform also has a trade minimum. Refer to the specific broker platform for details.

- Can I hold positions overnight on Google stocks?

You are allowed to leave open positions overnight. You may be charged a rollover fee for doing this.

- What happens to my open position on Google during public holidays?

All active positions will remain open and will be rolled over to the next trading day.

- Can I trade Google with a robot?

You can trade Google stocks with a robot if your broker offers the MT5 desktop platform (XM and Forex.com).

Comments are closed, but trackbacks and pingbacks are open.